Rental Property Improvements How Depreciation Works for Tax Deductions

In the event you have property or even are looking for investing in a single, comprehension decline can be an essential economic proficiency that will considerably affect a person’s bottom level line. One particular generally disregarded still important area of right here is the devaluation regarding property or home improvements. That blog site will certainly stop working precisely what devaluation to get apartment changes usually means and rental property improvements depreciation.

What the heck is Devaluation in Leasing House Advancements?

Decline is the process involving deducting the cost of physical property or home in excess of the useful life. With regard to local rental attributes, it is just a income tax benefit that lets you restore the price tag on deterioration of neglect the property. But if you help to make sizeable improvements—like including a different roof top, replacing your home, as well as putting in key fresh air conditioning—these furthermore get depreciation.

However, unlike common preservation costs, upgrades tend to be taken care of differently. Your IRS categorizes all of them seeing that cash enhancements, as well as they ought to be depreciated around their particular valuable lifetime, instead of expensed immediately.

The way Accounting allowance intended for Changes Is effective

Every single development declines under a unique sounding possessions allocated a useful existence from the IRS. For residential leasing homes, your most recent classes include

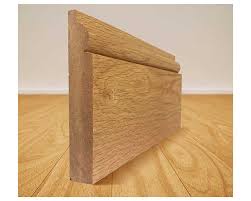

•Household Real Asset Changes such as the latest top as well as a part are depreciated over 27.5 years.

•Gear plus Lighting fixtures Such things as heating up programs or even home equipment may have reduced practical day-to-day lives, between 5 for you to 15 years—depending on IRS rules.

•Landscaping design Specified outdoor improvements such as provided driveways or even walls may well come under 15-year downgrading schedules.

This most commonly made use of way for working out wear and tear is the Revised Accelerated Expense Rehabilitation Technique (MACRS). Annually, the part of the improvement’s charge can be subtracted according to it is accounting allowance schedule.

The reason Decline upon Developments Things intended for Asset Owners

Being familiar with decline to get accommodation advancements can offer house entrepreneurs many perks

Taxes Benefits By deducting the price of upgrades through your after tax revenue every year, it is possible to significantly reduce your 12-monthly taxation bill.

Exact Personal Setting up Wear and tear makes certain you’regarding making up this gradual wear out with property after some time, considering much better financial forecasting.

Financial commitment Price Changes of which qualify for depreciation not merely help the property’s user friendliness however can also increase their appeal as well as long-term value.

Your Swift Tip regarding Consent

To say downgrading, you should hold detailed files of any development you’re making, their value, and its particular helpful life. The following paragraphs will possibly be required for filing accurate tax returns.

Capitalizing on income tax strengths such as wear and tear usually takes careful planning, however the dollars could be considerable pertaining to land lords exactly who continue to be knowledgeable as well as organized. Continually seek the advice of any duty qualified to get personal advice.